Simple and robust API to comply with the legal and technical requirements of Verifactu

Save hundreds of development hours and comply with Verifactu by integrating our API. The ideal solution for invoicing software developers and for any entity that wants to adapt to AEAT requirements through custom development. Also available for TicketBai.

How our Verifactu API works

A simple API to comply with all Verifactu legal requirements.

Some of our clients

“La integración con Verifactu fue muy sencilla y el soporte ha sido excelente. Siempre atentos y rápidos para resolver dudas. Muy contento con el servicio.”

“Hemos integrado nuestro software en tiempo record. La documentación es clara y sencilla, y los ejemplos variados y muy útiles. El equipo de soporte me ha ayudado con todas las dudas.”

“Verifacti's SaaS platform is intuitive and reliable, and their team's deep expertise and prompt, crystal-clear answers helped us reach our goals on time. They're not only highly knowledgeable and professional but also a genuine pleasure to work with.”

Your dream solution for Verifactu (and TicketBai)

An easy, secure, robust and affordable API.

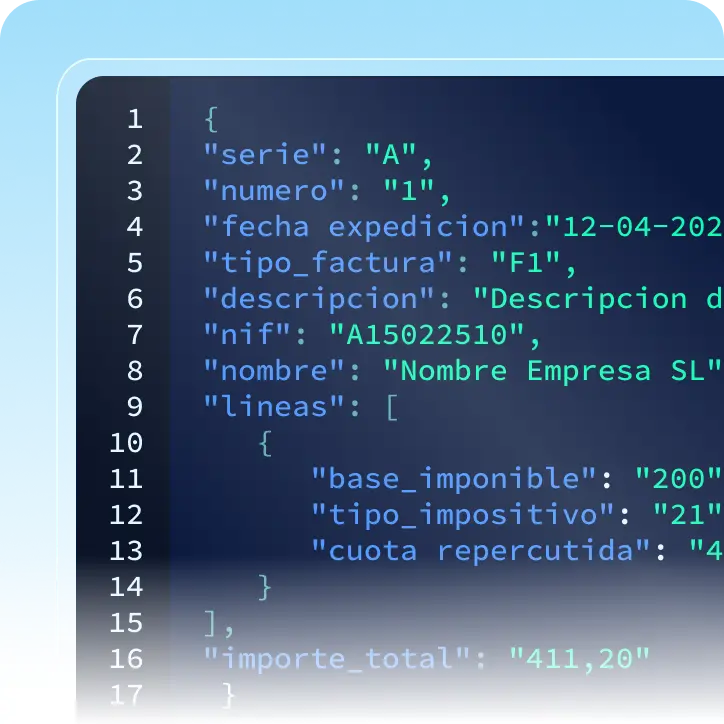

Save development time

Forget about dealing with XMLs, chaining, certificates. Send us your requests in simple JSON and save time and lines of code. We offer clear documentation and a development guide with examples to speed up your integration.

Meet the technical requirements

By integrating with our API you will comply with the current and future legal requirements of the tax agency, the Anti-Fraud Law and the VeriFactu system. When you integrate with our API, your software meets the regulations and technical requirements, with the guarantee of always being up to date with new requirements.

Easy management of permissions and certificates

Forget about dealing with certificates. Verifacti is a social collaborator of the AEAT and we will use our own representative certificate for submitting your invoicing information or that of your users. We offer simple management of representation models via web or via API.

Help with your responsible declaration

Forget about certification processes or audits. Make a simple responsible declaration to comply with Verifactu. We provide you with a declaration draft and clarify where and how to display that declaration.

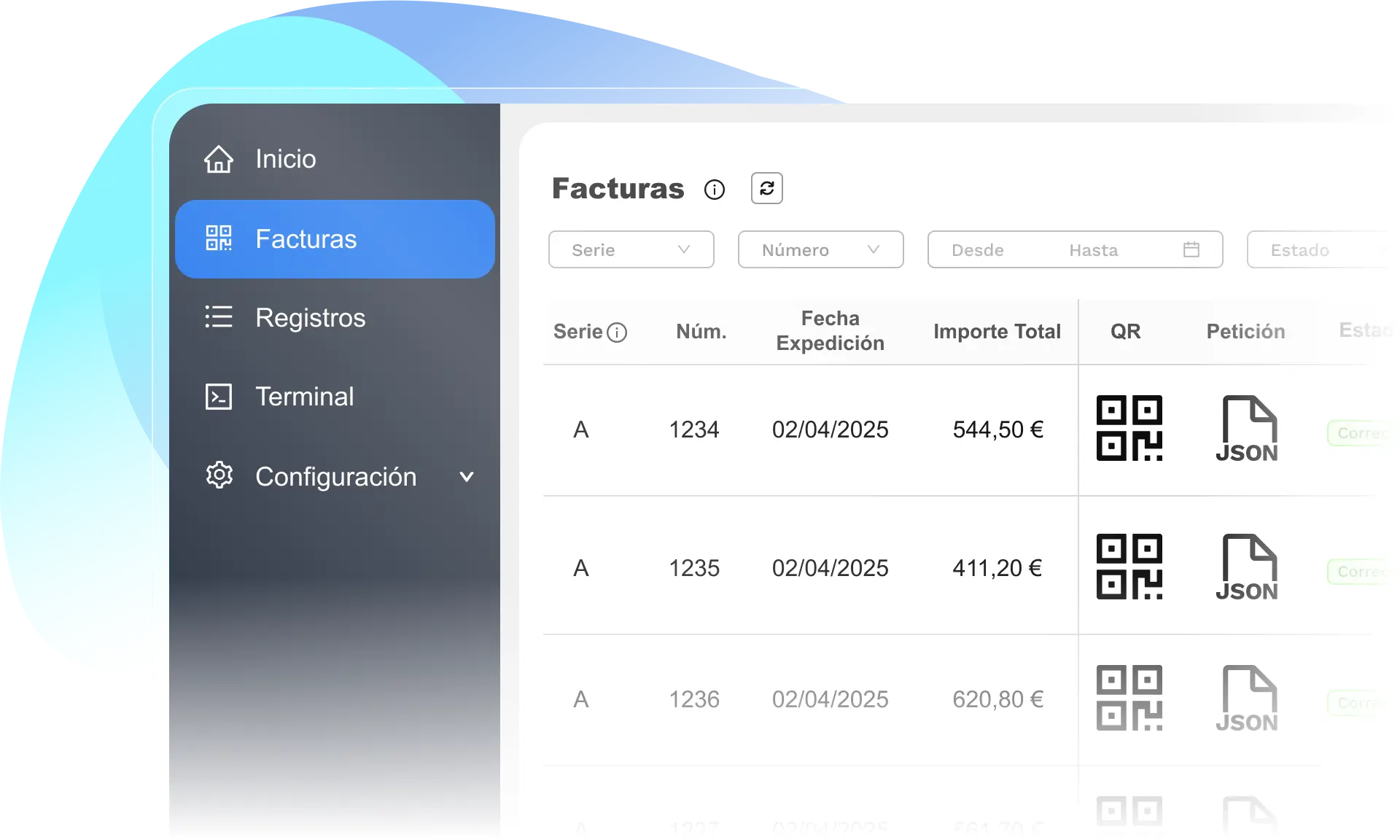

Submission log and invoice listing

Interested in keeping the XMLs? Although the preservation of invoicing records (XMLs) is not mandatory in Verifactu mode, we store them for years and make them available for download at any time.

Complete and simple web interface

Speed up your integration and streamline the verification of your invoices and submissions to the AEAT on the Verifacti web platform. You can manage NIFs, list invoices and invoicing records, access the terminal and much more.

Minimize errors in your submissions

Our API can detect errors before submission to the AEAT. We notify you and help you correct your calls to avoid requests with errors. This way, you will save additional rectification, cancellation or amendment requests.

Cloud infrastructure with automatic scaling

Our API is deployed on a serverless container-based architecture, enabling automatic scaling based on load. Each request is processed in isolated environments, optimized for high availability, low latency and controlled concurrency.

Simple integration

Save hundreds of hours of development and maintenance through a simple and clear integration with our Verifactu API.

Simple and clear documentation

Explore our concise and clear documentation for an API with just the right endpoints needed to fulfill its mission.

Integration guide with examples and executables

The information you need to facilitate your integration, including call examples and executables.

Free account with test NIF

Do your integration at no cost with your free account that includes a test NIF to make calls to the administration's test environment.

Dedicated support

We help our clients resolve their questions by email and phone to achieve a fast and secure integration.

A solution designed for developers

A simple and robust solution for any use case.

Are you a software developer?

Adapt and certify your management software effortlessly to fully comply with the Anti-Fraud Law.

ERP manufacturer

ERP integrator

Invoicing software

POS software

PMS software

Mobile app developer

Technology consultancy

Software providers

And much more

Do you need to adapt your own software?

If you have created your own software for your company and need to adapt it to the Anti-Fraud Law and VeriFactu, our VeriFactu API is the ideal option for your business, whether it is a small or large company.

Adapt your own invoicing software

Integrate your Stripe or any payment gateway

Adapt your Shopify, WooCommerce or any online store

Update your own ERP with your development team

And much more

Ideal solution for large clients

All the easiness and security required by software with hundreds or thousands of taxpayers.